defer capital gains tax australia

The small business capital gains tax CGT concessions allow you to reduce disregard or defer some or all of a capital gain from an active asset used in a small business. There can be a big difference in.

United States Taxation Of International Executives Kpmg Global

How long do I need to live in a house to avoid capital gains tax.

. One year is the dividing line between having to pay short term versus long term capital gains tax. Learn the IRS strategy of selling your capital asset without the restrictions of a 1031. Rather it is deferred into another property.

Defer capital gains tax australia. The deferral is in effect until the QOF investment is sold or exchanged or on Dec. The gain is deferred until December 31 2026or to the year when the.

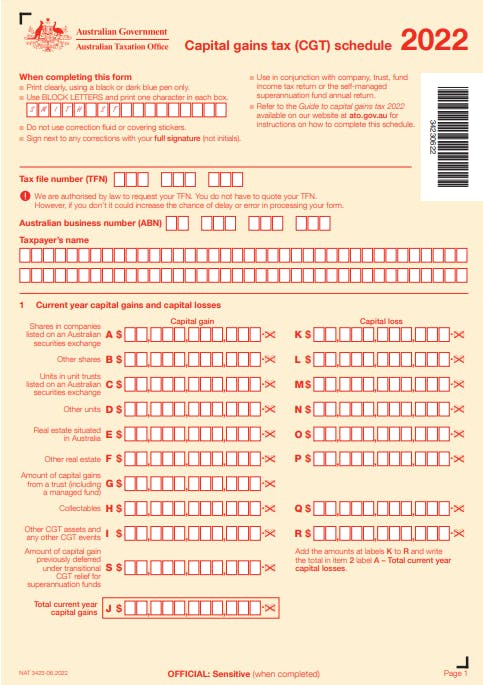

Any mischief is involved. Your expenses are 70000. These myTax 2021 instructions are about capital gains tax events capital gains income and capital losses.

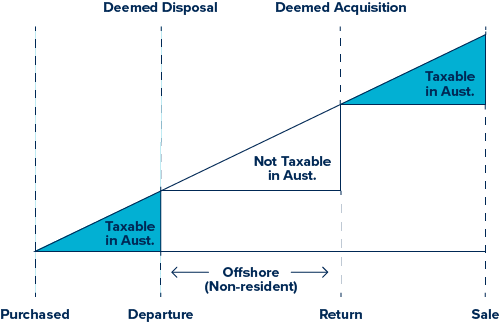

Under current law short-term capital gains are treated as ordinary income with a top tax rate of 408 370 plus 38 net investment income tax NIIT. The investor is then exempt from income tax for that proportion of the income distributions they have. Leaving Australia means capital gains tax can arise - CGT Event I1 - as there is a deemed disposal of investments at their market value.

Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most. Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are. Your income is 75000 and your annual tax rate is 325.

Check if your assets are subject to CGT exempt or pre-date CGT. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. 31 2026 whichever comes first.

Owners of highly appreciated assets are often highly reluctant to sell because of the capital gains taxes that are typically due upon closing. Can You Defer Capital Gains. You sell the rental property for 600000.

For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. Would you sell if it were not for Capital Gains Taxes.

Businesses wishing to use the small business CGT concessions can also apply for an extension in situations where they need to take a certain action within a certain. Defer Capital Gains Taxes. Sell the Property After 1 Year.

Defer capital gains tax australia Monday June 20 2022 Edit. In most cases it can be used to reduce a capital gain you made in 202021. Skip to primary navigation.

You purchased your rental property for 350000. A Tax-deferred rate will be determined for each financial year eg.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

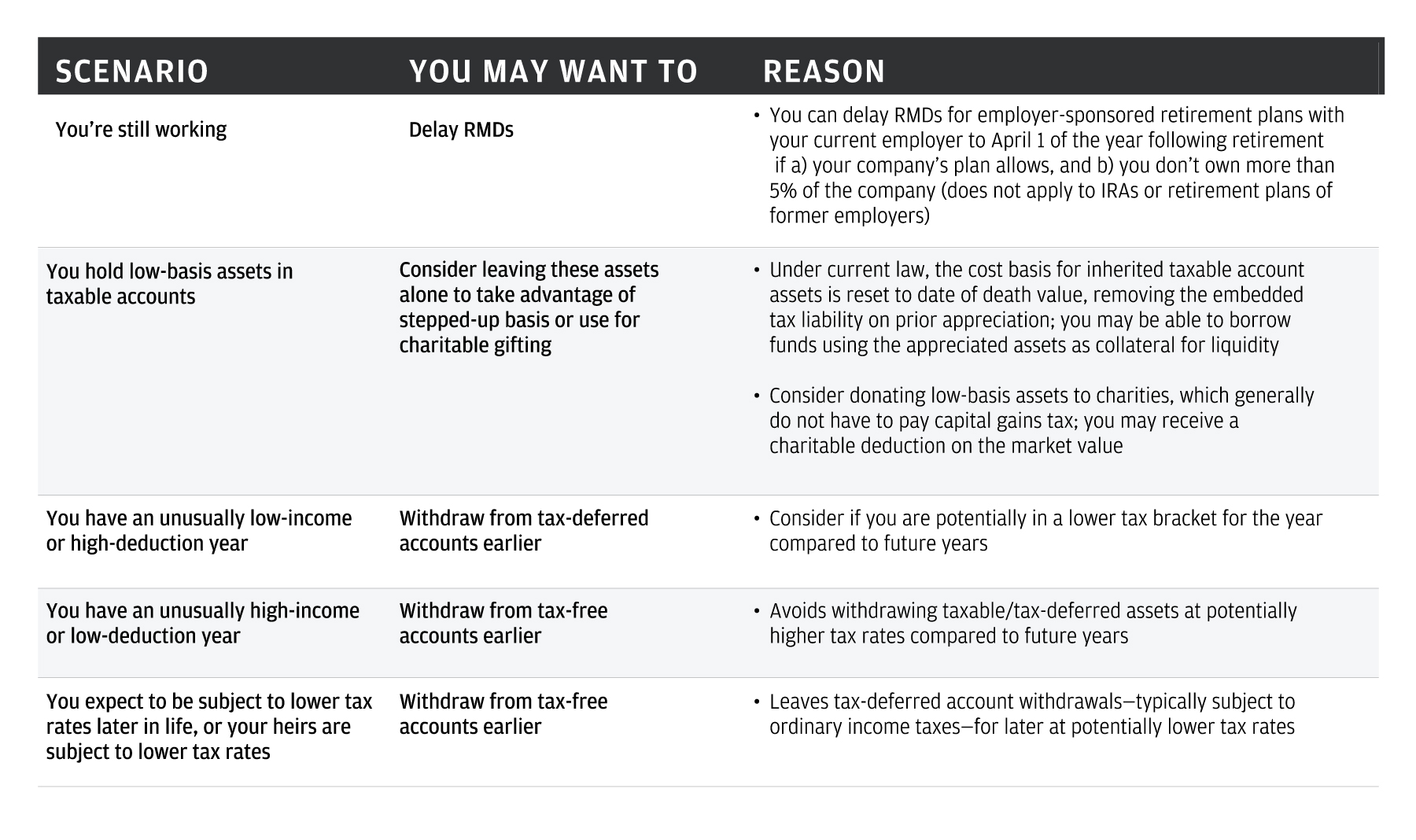

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Accountant S Australia Crypto Tax Guide Koinly

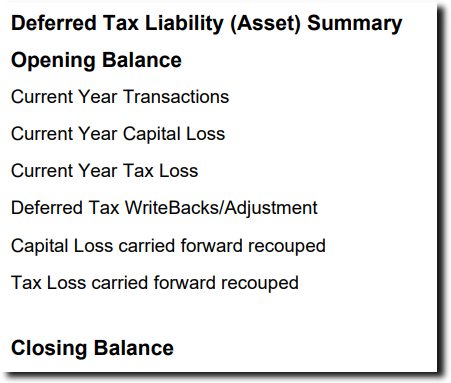

Deferred Tax Reconciliation Report Simple Fund 360 Knowledge Centre

Double Taxation Of Corporate Income In The United States And The Oecd

How Much Tax Will I Pay If I Flip A House New Silver

/images/2021/05/05/happy-young-investor.jpg)

How To Avoid Capital Gains Tax On Stocks 7 Tricks You Need To Know Financebuzz

How To Avoid Capital Gains Taxes Smartasset

How To Avoid Capital Gains Tax Personal Capital

What Is A 1031 Exchange Rules Requirements Process

What Is A Deemed Disposal Atlas Wealth Management

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Us Tax On Australian Superannuation Funds Htj Tax

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax